Introduction

The glamour of Mastering the Art of Intraday Trading strategies lies in their potential to generate significant returns within a short period. However, it’s crucial to understand that this form of trading also carries inherent risks. Especially in today’s environment with rising inflation, many are seeking additional income streams. Intraday trading can be a tempting option, but remember, success requires discipline, knowledge, and a well-defined strategy. Intraday trading, also known as day trading, is a fast-paced and exciting approach to stock market participation. Unlike traditional investing where you buy and hold assets for the long term, intraday trading focuses on capitalizing on short-term price movements within a single trading day. This guide delves into the world of intraday trading strategies, equipping you with the knowledge and tools to navigate this dynamic market.

In this article, we will explore various intraday trading strategies, market risks, and valuable tips to help you navigate the world of day trading.

Overview Of Mastering the Art Of Intraday Trading Or Short-Term Trading

This means that all trades are executed and settled within the same day, and no positions are held overnight. Unlike long-term investors who hold positions for extended periods, day traders capitalize on short-term price fluctuations.

Here’s a breakdown of the key aspects of intraday trading:

- Timeframe: Positions are opened and closed within the same trading day.

- Focus: Intraday traders primarily focus on technical analysis, utilizing charts and indicators to identify potential price movements.

- Profit Potential: Day trading strategies aim to capture profits from small price changes throughout the trading day.

It’s important to remember that intraday trading strategies carry inherent risks. Market volatility and emotional decision-making can lead to significant losses.

Importance of Additional Income Due to Inflation

In an environment with high inflation, the value of money decreases, resulting in a decrease in its purchasing power. This can motivate individuals to explore additional income streams to maintain their financial standing. Intraday trading presents a potential avenue to generate extra income, but it requires a significant investment of time, and effort, and carries inherent risks.

Types of Trading

Before delving into intraday trading strategies, let’s explore the different types of trading:

- Share Market Trading: This involves buying and selling individual company stocks, aiming to profit from price movements.

- Mutual Fund Trading: Mutual funds pool money from multiple investors and invest it in a basket of securities. They offer diversification and professional management but may not align with short-term trading goals.

Market Risks

Understanding market risks is paramount before venturing into intraday trading. Here are some key considerations:

- Volatility: Stock prices can fluctuate significantly throughout the day, leading to potential losses.

- Liquidity Risk: Liquid stocks may be difficult to enter or exit positions quickly, hindering your ability to capitalize on opportunities.

- Emotional Trading: Letting emotions dictate your trades can lead to impulsive decisions and significant losses.

Intraday Trading Basics

Same-Day Buying and Selling

Intraday strategies involve buying a security (going long) with the expectation that its price will rise or selling a security short (borrowing and selling a security with the expectation the price will fall) within the same trading day. The goal is to profit from price movements before the market closes.

Profit Example:

Let’s consider a simplified example. Imagine that you have bought 100 shares of a company’s stock for $10 per share. During the day, the price rises to $10.50. You then decide to sell your 100 shares, pocketing a profit of $50 (100 shares * ($10.50 – $10)).

Best Intraday Trading Strategies

Having grasped the fundamentals of intraday trading, let’s delve into various effective strategies you can employ:

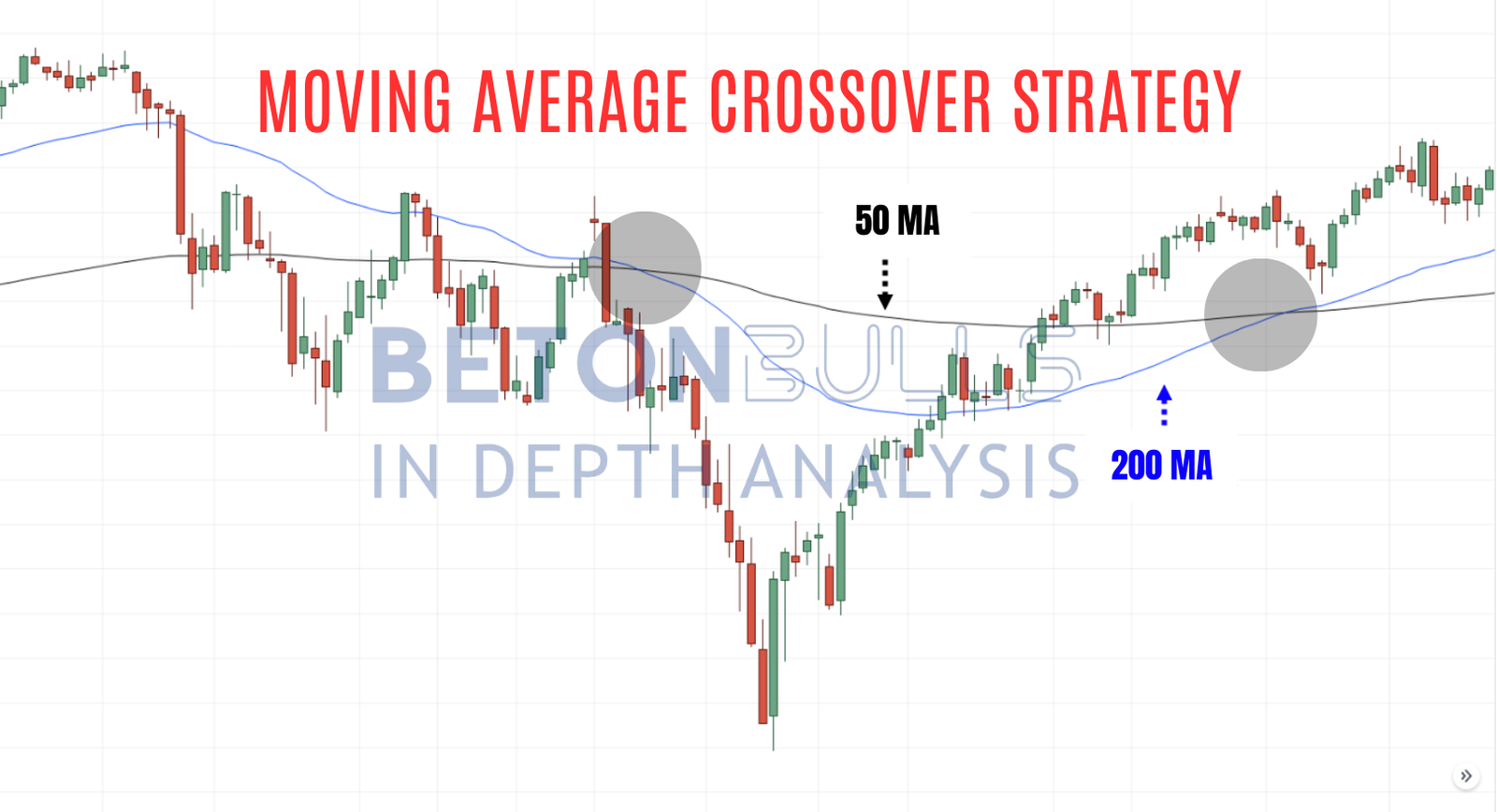

Moving Average Crossover Strategy

The moving average crossover strategy utilizes moving averages, and technical indicators that smooth out price fluctuations to identify potential trends. There are two main types of crossovers.

- Golden Cross: When a short-term moving average crosses above a long-term moving average, it may signal a potential uptrend. This can be a buy signal for intraday traders.

- Death Cross: Conversely, when a short-term moving average falls below a long-term moving average, it may indicate a downtrend. This can be a sell signal for day traders.

When analyzing the market, it’s important to keep in mind that moving averages are lagging indicators. This means that they react to past price movements and should be used in conjunction with other technical analysis tools to confirm trends.

Reversal Trading Strategy

Reversal trading strategies focus on identifying and capitalizing on potential price reversals. Here are two common approaches:

- Support and Resistance Levels: Support refers to price levels where a stock tends to find buyers, preventing further downside. Conversely, resistance indicates areas where selling pressure might increase, halting a stock’s upward momentum. Identifying potential reversals near these levels can be profitable for intraday traders.

- Chart Patterns: Technical analysis incorporates various chart patterns that may suggest a potential reversal in trend. Examples include head and shoulders patterns, double tops/bottoms, and bullish/bearish engulfing patterns.

Remember: Reversal trading can be challenging, and successful execution requires experience and a keen understanding of technical analysis.

Momentum Trading Strategy

Momentum trading strategies capitalize on stocks with strong price movements in a particular direction. The underlying assumption is that stocks with significant upward or downward momentum are likely to continue in that direction for a short period.

Here are some tools momentum traders use:

- Volume: High trading volume often accompanies strong price movements.

- Relative Strength Index (RSI): This indicator measures recent price movements to identify overbought or oversold conditions.

Remember: Momentum trading can be risky, especially in volatile markets. It’s important to note that stocks that have been performing well can experience sudden changes in direction, resulting in substantial losses.

Gap Up and Gap Down Trading Strategy

The gap up and gap down strategy focuses on stocks that open with a significant price difference (gap) compared to their previous day’s closing price. There are two main approaches.

- Gap Up: When a stock price gaps up at the open, it suggests strong buying pressure. Intraday traders might buy the stock, anticipating the gap to close higher by the day’s end.

- Gap Down: Conversely, a gap-down opening suggests selling pressure. Day traders might short the stock (borrow and sell) expecting the price to continue falling throughout the day.

Remember: Gap-up and gap-down strategies can be risky, and the gaps may not necessarily close during the trading day.

Bull Flag Trading Strategy

The bull flag pattern is a technical indicator that can signal a continuation of an uptrend. It resembles a flag on a pole, where the pole represents a sharp price increase, followed by a period of consolidation within a defined price range (the flag). A breakout from the upper trendline of the flag can be a buy signal for intraday traders, anticipating a continuation of the uptrend.

Remember: Confirmation from other technical indicators is recommended before acting on a bull flag pattern.

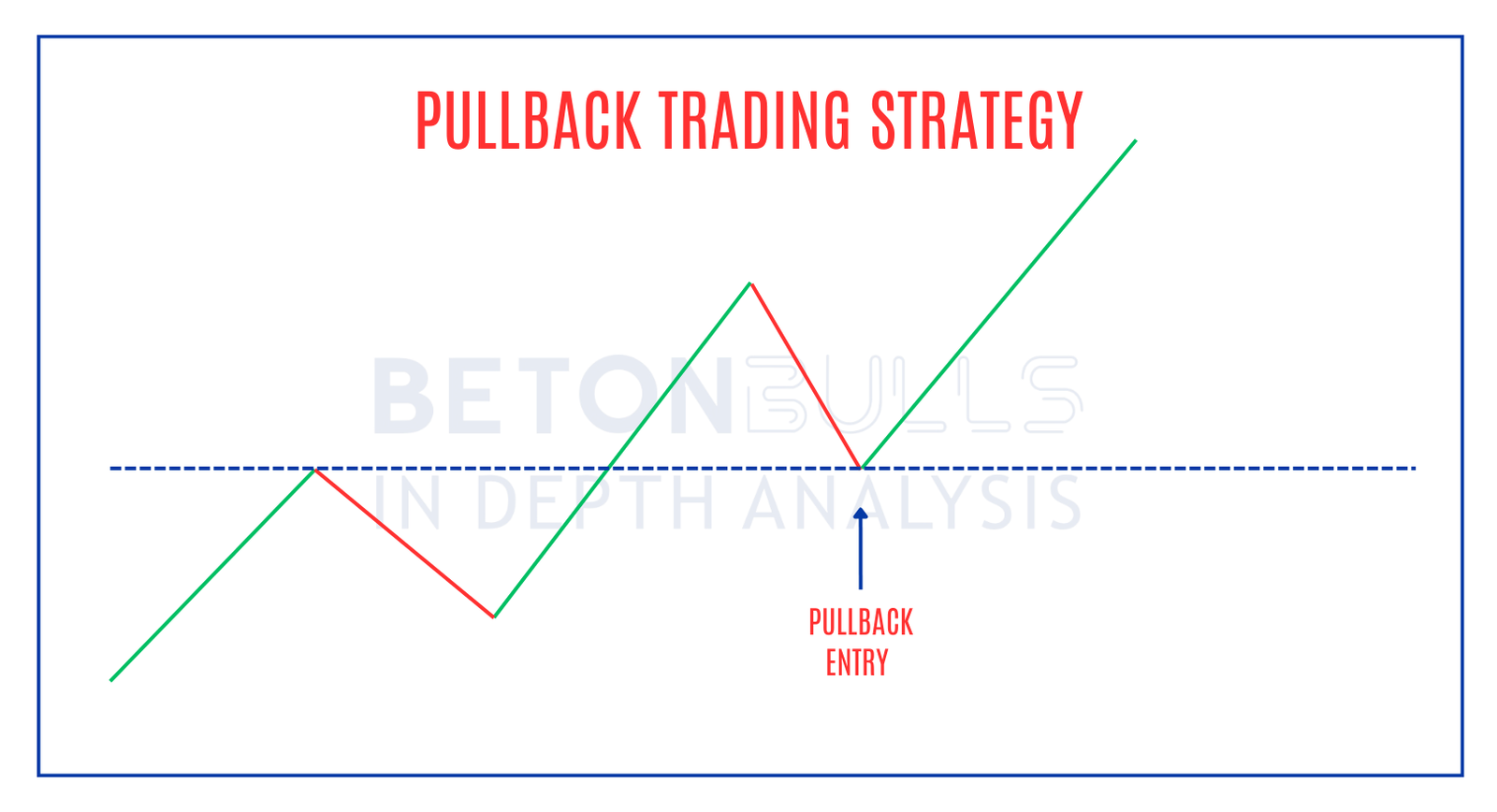

Pullback Trading Strategy

Pullback trading strategies aim to capitalize on temporary dips in an otherwise uptrending stock. The underlying assumption is that these pullbacks present buying opportunities as the stock is likely to resume its upward trajectory.

Here’s how pullback trading works:

- Identify an uptrending stock.

- Look for a retracement (pullback) in price.

- Enter a long position (buy) if the pullback holds support levels (areas where buying pressure typically emerges).

Remember: Successfully identifying true pullbacks versus trend reversals requires experience and a solid understanding of technical analysis.

Intraday Trading Tips

While mastering intraday trading strategies takes time and practice, here are some valuable tips to enhance your experience:

Choose Liquid Shares

Focus on stocks with high trading volume (liquidity). This ensures you can enter and exit positions quickly, minimizing the risk of getting stuck in illiquid holdings.

Utilize Stop-Loss Orders

Stop-loss orders are essential risk management tools. They automatically sell your holdings when the price reaches a predetermined level, limiting potential losses.

Avoiding Volatile Stocks

Especially for beginners, avoid extremely volatile stocks. Their erratic price movements can be challenging to predict and magnify potential losses.

Considering Correlated Stocks

Adding correlated stocks to your portfolio can help manage risk. When one stock price moves, the other tends to follow in the same direction. This can help offset losses in one holding with gains in another.

Choosing Transparency

Maintain transparency in your trading activities. Track your wins and losses to identify areas for improvement and develop a data-driven approach to your trading decisions.

News-Sensitive Stocks

Be cautious with news-sensitive stocks. Sudden news announcements can trigger significant price swings, making them challenging to navigate for day traders.

Conclusion

Intraday trading strategies offer the potential for substantial returns, but they also carry inherent risks. By thoroughly understanding these strategies, effectively managing risk, and employing sound trading practices, you can increase your chances of success in the fast-paced world of day trading.

Remember, this blog post serves as a stepping stone. Consistent practice, ongoing education, and a disciplined approach are paramount for navigating the complexities of intraday trading.

Frequently Asked Questions

- How Does Intraday Trading Work?

Intraday traders analyze market trends, identify trading opportunities, and execute buy and sell orders throughout the trading day. They aim to profit from even minor price fluctuations.

- What are the Best Intraday Trading Strategies?

There’s no single “best” strategy. Popular approaches include moving average crossover, reversal trading, and momentum trading. Each strategy has its advantages and disadvantages. It’s crucial to understand them and choose the ones that suit your trading style and risk tolerance.

- How to Reduce Risks in Intraday Trading?

- Utilize stop-loss orders: These automatically exit your trade when the price reaches a predetermined level, limiting potential losses.

- Maintain proper risk management: Only invest a portion of your capital that you can afford to lose.

- Be mindful of your emotions: Avoid making decisions based on fear or greed as it can impair your judgment. It is important to adhere to your trading plan and to exit positions when it is necessary.

- Why is Stock Selection Crucial in Day Trading?

The right stock selection can significantly impact your trading success. Choose liquid stocks with a moderate level of volatility and a history of transparency from the company.

- What are some tips for beginners who want to start intraday trading?

- Start with a demo account to practice your skills before risking real capital.

- Focus on learning and understanding core concepts before implementing complex strategies.

- Maintain a disciplined approach and prioritize risk management.

- How Does CFD Work in Intraday Trading?

Contracts for Difference (CFDs) are financial instruments that track the underlying asset’s price movement without actually owning the asset. They can be used for leveraged trading, which amplifies both potential profits and losses. Due to the inherent risk, CFD trading is generally not recommended for beginners.

- What is the Scalping Strategy in Intraday Trading?

Scalping involves taking numerous small profits from short-term price movements throughout the trading day. It requires a high level of focus, and quick reaction times, and often involves significant trading fees.

- How Can One Trade News-Sensitive Stocks in Intraday Trading?

Stay updated on relevant industry news and potential company announcements. Look for trading opportunities based on how the news might impact the stock price. However, news-sensitive stocks can be highly volatile, so proper risk management is crucial.

- Why is Transparency Important in Selecting Stocks for Intraday Trading?

Transparency allows you to assess the company’s financial health and identify potential risks or opportunities that might impact the stock price. Regularly reviewing financial statements and press releases can help you make informed trading decisions.