Introduction

Crude oil, also known as petroleum, is a naturally occurring liquid found beneath the Earth’s surface. It’s a complex mixture of various hydrocarbons, organic compounds formed primarily from hydrogen and carbon. We often visualize crude oil as the black goo used in car engines, but it actually comes in a variety of colors, from light yellow to nearly black.

Beyond fueling our vehicles, crude oil is a critical ingredient in countless industries. Think of everyday items like plastic bottles, clothing, and even medicines – all these rely on crude oil as a raw material.

The significance of crude oil extends far beyond everyday products. It plays a vital role in global energy production and transportation. Power plants, airplanes, and ships all depend on refined products derived from crude oil. This underscores the importance of understanding not just what crude oil is, but also how it’s traded and accessed.

This is where the Indian stock market comes in. While stocks represent ownership in companies, the Indian stock market also facilitates trading in commodities like crude oil. In the next section, we’ll delve into the exciting world of commodity trading and how it specifically applies to crude oil.

Understanding the Commodity Sector

The term “stock market” often brings to mind companies and their shares. However, there’s another whole section dedicated to trading things we can’t necessarily hold in our hands – commodities.

A. What are Commodities?

Commodities are basic goods used as raw materials in various industries. They can be broadly categorized into four groups:

- Energy: This includes crude oil, natural gas, and coal – the fuels that power our world.

- Metals: From gold and silver to copper and iron, metals play a crucial role in construction, manufacturing, and electronics.

- Agricultural Products: This group encompasses grains like wheat and corn, as well as softs like coffee and sugar. These form the backbone of our food and beverage industries.

- Livestock and Meat: Commodities exchanges also facilitate trading in live animals and meat products.

B. The Role of Commodities in Global Economics

Imagine a global supply chain – a complex network that moves goods across borders. Commodities are the building blocks of this network. Their prices are influenced by factors like weather, geopolitical events, and global demand. Understanding these factors and how they affect commodity prices is crucial for businesses and investors alike.

Trading Options in the Crude Oil Sector

The Indian stock market, through the Multi Commodity Exchange (MCX), offers a variety of instruments for trading crude oil. Let’s explore some popular options, keeping in mind their suitability for intraday trading and investment:

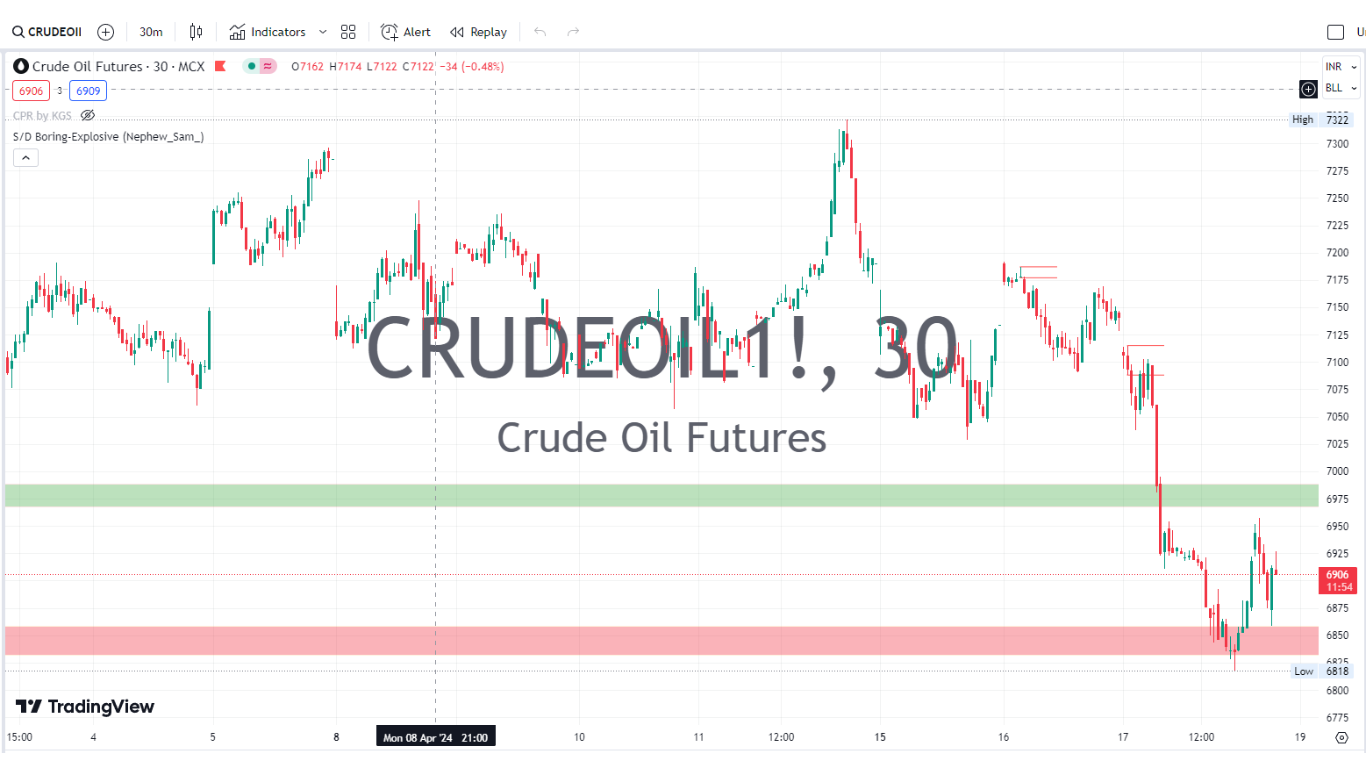

A. Futures Contracts

- What are Futures Contracts?

Imagine you agree to buy 100 barrels of crude oil at a predetermined price on a specific future date. That’s essentially a futures contract. You speculate on the price movement – if the price goes up before the delivery date, you can potentially make a profit by selling your contract at a higher price. Conversely, if the price falls, you might face a loss.

- Where are Futures Contracts Traded in India?

The MCX is the primary exchange for trading crude oil futures contracts in India. These contracts are standardized, meaning they have a fixed size (usually 100 barrels) and expiry date.

- Benefits and Risks of Trading Crude Oil Futures

Benefits:

- Potential for high profits: Leveraging price movements can amplify gains, especially for short-term traders.

- Hedging: Companies involved in the oil industry can use futures contracts to mitigate price risks.

Risks:

- High volatility: Crude oil prices can fluctuate significantly, leading to substantial losses.

- Margin requirements: You need to deposit a margin (initial investment) to hold a futures contract, which can be a significant amount.

Focus on Intraday vs. Investment: Due to their volatile nature, futures contracts are better suited for experienced traders comfortable with short-term price movements. They might not be ideal for long-term investors seeking a more stable approach.

B. Options Contracts

- What are Options Contracts?

Unlike futures contracts that obligate you to buy or sell at a specific date, options contracts grant you the right, but not the obligation, to buy (call option) or sell (put option) crude oil at a predetermined price (strike price) by a certain expiry date. This offers more flexibility than futures contracts.

- How Options Contracts Work in Crude Oil Trading

Imagine you believe crude oil prices will rise. You can buy a call option with a strike price slightly above the current market price. If your prediction is correct, and the price rises above the strike price by expiry, you can exercise the option to buy crude oil at the lower strike price and sell it immediately at the higher market price, pocketing the difference. However, if the price falls, you simply lose the premium paid for the option contract.

Advantages and Disadvantages of Options Trading

Advantages:

- Limited downside risk: Your maximum loss is limited to the premium paid for the option.

- Profit potential: Options offer leverage, allowing for significant profits if your price predictions are accurate.

Disadvantages:

- Time decay: The value of an option contract erodes over time, even if the underlying price stays flat. This can be a challenge for long-term investors.

- Complexity: Options trading requires a good understanding of market dynamics and option pricing strategies.

Focus on Intraday vs. Investment: Options offer more flexibility than futures contracts and can be suitable for both intraday trading with well-defined strategies or for longer-term directional bets on crude oil prices.

C. Exchange-Traded Funds (ETFs):

- What are Crude Oil ETFs?

Imagine a basket containing various assets that track the performance of the crude oil market. That’s essentially a crude oil ETF. These ETFs hold underlying assets like crude oil futures contracts or stocks of companies involved in the oil sector. By investing in a crude oil ETF, you gain exposure to the crude oil market without the complexities of directly managing futures or option contracts.

- Gaining Exposure to Crude Oil Through ETFs

There are various crude oil ETFs available on the Indian stock market. Some track domestic crude oil prices, while others are linked to international benchmarks like Brent crude. Investing in a crude oil ETF allows you to participate in the price movements of the underlying crude oil contracts or stocks without the need to manage individual contracts.

- Considerations for Investing in Crude Oil ETFs

Advantages:

- Diversification: ETFs offer a diversified exposure to the crude oil market, reducing risk compared to individual stock picking.

- Lower barrier to entry: ETFs typically require a smaller investment compared to futures contracts.

- Liquidity: ETFs are generally more liquid than futures contracts, making it easier to enter and exit positions.

Disadvantages:

- Tracking error: The ETF’s performance might not perfectly mirror the underlying crude oil prices due to management fees and other expenses.

- Market volatility: Crude oil prices can be volatile, and this volatility will be reflected in the ETF’s price.

Focus on Intraday vs. Investment: While some actively managed crude oil ETFs might be suitable for intraday trading strategies, ETFs are generally better suited for long-term investors seeking exposure to the crude oil market without the complexities of futures or options trading.

D. Exchange-Traded Notes (ETNs):

- What are ETNs and their Role in Crude Oil Trading?

Similar to ETFs, ETNs are debt instruments listed on a stock exchange. However, unlike ETFs that hold underlying assets, ETNs represent unsecured debt obligations of the issuing bank. In the context of crude oil, an ETN might track the performance of an oil index or a basket of crude oil futures contracts. By investing in a crude oil ETN, you’re essentially lending money to the issuing bank, which in turn uses those funds to track the crude oil market.

- Benefits and Risks of Trading Crude Oil ETNs

Benefits:

- Convenience: ETNs offer similar benefits to ETFs in terms of ease of trading and liquidity.

- Potential for high returns: Some ETNs are structured to offer leveraged exposure to the crude oil market, amplifying potential returns (and losses).

Risks:

- Counterparty risk: Unlike ETFs that hold underlying assets, ETNs rely on the creditworthiness of the issuing bank. If the bank defaults, you might lose your entire investment.

- Limited transparency: The structure of some ETNs can be complex, making it challenging to fully understand the associated risks.

Focus on Intraday vs. Investment: While leveraged ETNs might be tempting for intraday traders seeking amplified returns, the high counterparty risk makes them less suitable for most investors. They are generally better suited for sophisticated investors comfortable with complex financial instruments.

E. Direct Investment in Oil Companies

- Investing in Oil Companies

This approach involves buying shares of companies involved in the exploration, production, refining, or transportation of crude oil. By investing in these companies, you’re essentially betting on their long-term success, which is tied to the overall health of the oil industry.

- Factors Influencing Oil Company Stock Prices

Several factors can influence the stock prices of oil companies, including:

- Crude oil prices: A rise in crude oil prices generally benefits oil companies.

- Company performance: The financial health, exploration success, and production efficiency of the company all play a role.

- Geopolitical events: Events in oil-producing regions can significantly impact oil prices and, consequently, oil company stocks.

- Risks and Potential Rewards of Investing in Oil Stocks

Advantages:

- Potential for high returns: Oil companies can offer significant capital appreciation if the oil price rises or the company performs exceptionally well.

- Dividends: Many oil companies pay regular dividends to their shareholders, providing a steady stream of income.

Disadvantages:

- Volatility: Oil company stocks can be quite volatile due to their dependence on the fluctuating price of crude oil.

- Industry risk: The oil industry is subject to various risks, such as environmental regulations and the shift towards renewable energy sources.

Focus on Intraday vs. Investment: While day trading oil stocks can be attempted by experienced investors, direct investment in oil companies is generally a better fit for long-term investors seeking exposure to the oil industry through established companies.

Conclusion

The world of crude oil trading offers a variety of avenues for investors and traders with different goals. We’ve explored instruments ranging from the high-risk, high-reward world of futures contracts to the more diversified approach of Exchange-Traded Funds. The key takeaway is to carefully consider your investment horizon, risk tolerance, and trading experience before venturing into any of these options.

Here are some additional points to remember:

- Start with a demo account: Many online brokers offer demo accounts with virtual currency. This allows you to experiment with different trading strategies and instruments in a risk-free environment before committing real capital.

- Stay informed: The crude oil market is constantly evolving. Keep yourself updated on global oil production, consumption trends, and geopolitical events that can impact prices.

- Seek professional advice: Consulting a financial advisor can be especially helpful if you’re new to trading or have a complex investment portfolio.

By understanding the intricacies of the crude oil market and the instruments available, you can make informed decisions to potentially capitalize on the opportunities this dynamic sector presents.

FAQs on Crude Oil Trading in India

- What’s the difference between Futures Contracts and Options Contracts for crude oil?

- Futures Contracts: Obligate you to buy or sell a specific amount of crude oil at a predetermined price by a certain date. Offers high leverage but carries high risk of loss due to price fluctuations.

- Options Contracts: Grant you the right, but not the obligation, to buy (call option) or sell (put option) crude oil at a predetermined price by a certain date. Offers more flexibility and limited downside risk compared to futures contracts.

- Are Exchange-Traded Funds (ETFs) a good way for beginners to invest in crude oil?

Yes, ETFs can be a good option for beginners. They offer several advantages:

- Diversification: Reduces risk by investing in a basket of assets linked to crude oil, not just a single company.

- Lower investment: Requires a smaller amount compared to futures contracts.

- Liquidity: Easier to enter and exit positions compared to complex contracts.

- What are the risks involved in investing in oil companies?

While oil companies can offer high returns, they also come with inherent risks:

- Volatility: Stock prices fluctuate significantly due to dependence on the volatile crude oil market.

- Industry Risk: The oil industry faces challenges like environmental regulations and the shift towards renewable energy.

- Is day trading crude oil a good idea?

Day trading crude oil futures or options contracts can be very risky, especially for beginners. It requires a deep understanding of the market, significant experience, and a high tolerance for risk.

- What resources can help me learn more about crude oil trading?

Many online resources and brokerage firms offer educational material on crude oil trading. Consider:

- Reputable financial websites

- Online courses or webinars

- Educational content from your chosen brokerage firm

- Should I consult a financial advisor before investing in crude oil?

Consulting a financial advisor can be beneficial, especially for beginners or those with complex financial goals. They can help you assess your risk tolerance and develop a suitable investment strategy.